Donate

Join in our Shared Purpose

The Florida Aquarium relies on your support to fund critical environmental conservation efforts, community and outreach programs, and the care of our resident animal ambassadors. Please consider making a tax-deductible donation today.

General Support

Your contribution to The Florida Aquarium will have a positive impact on our organization and our shared purpose to save marine wildlife.

By supporting world-class animal care practices, community impact projects, education programming, conservation efforts and research initiatives, together we WILL inspire, facilitate and create change for the preservation of the natural environment. Learn more about the important programs you can support through meaningful contributions to The Florida Aquarium.

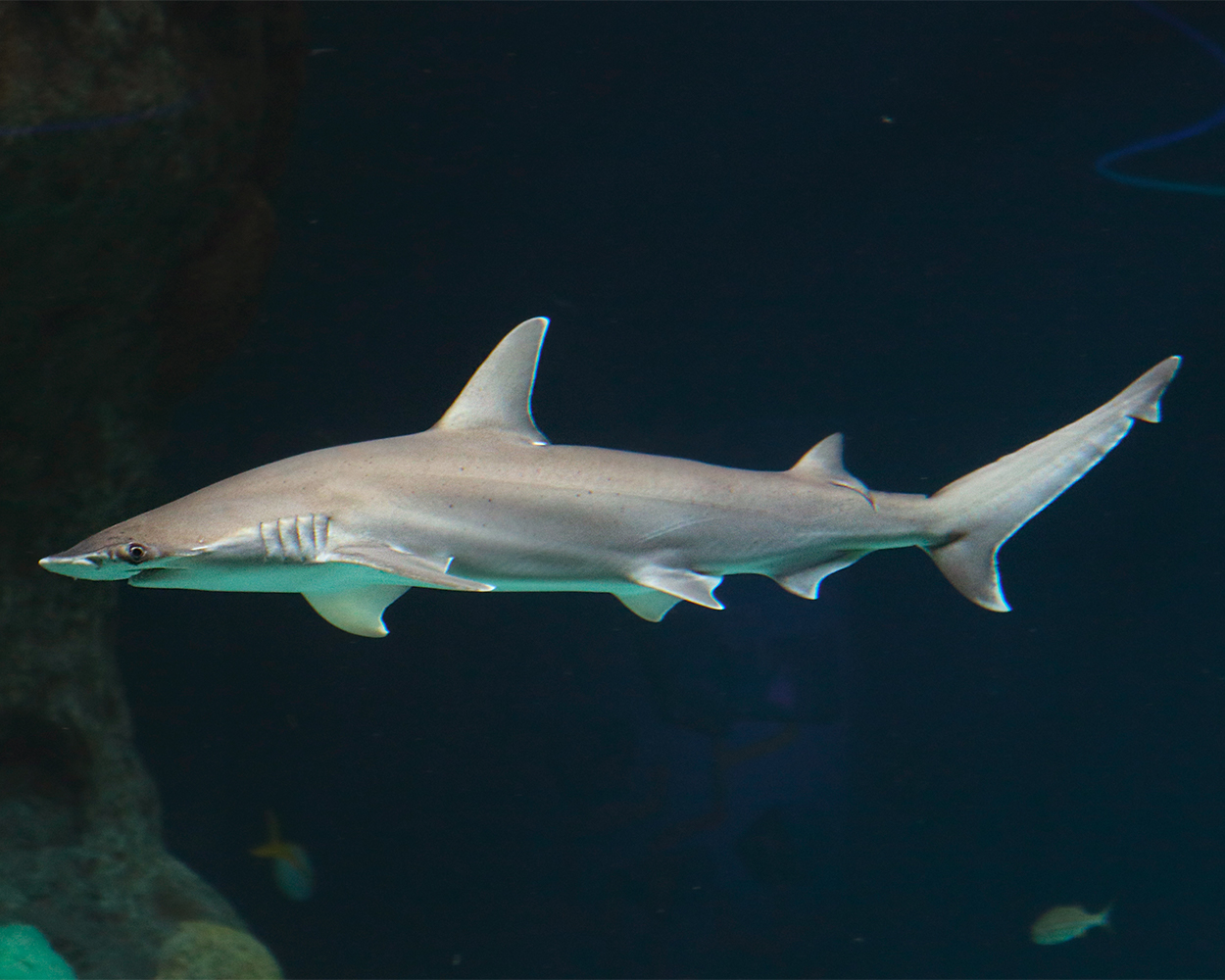

Symbolic Animal Adoption

At The Florida Aquarium, it is our privilege to provide a home to a variety of animal ambassadors. Their well-being is our highest priority. From the smallest reptile to the largest elasmobranch, nothing short of world-class animal care will do! And you can help!

With multiple levels from which to choose, the symbolic adoption program helps provide critical funds for animal care and welfare. Supporters receive a variety of gifts at varying levels, including educational information, adoption certificates and plush toys.

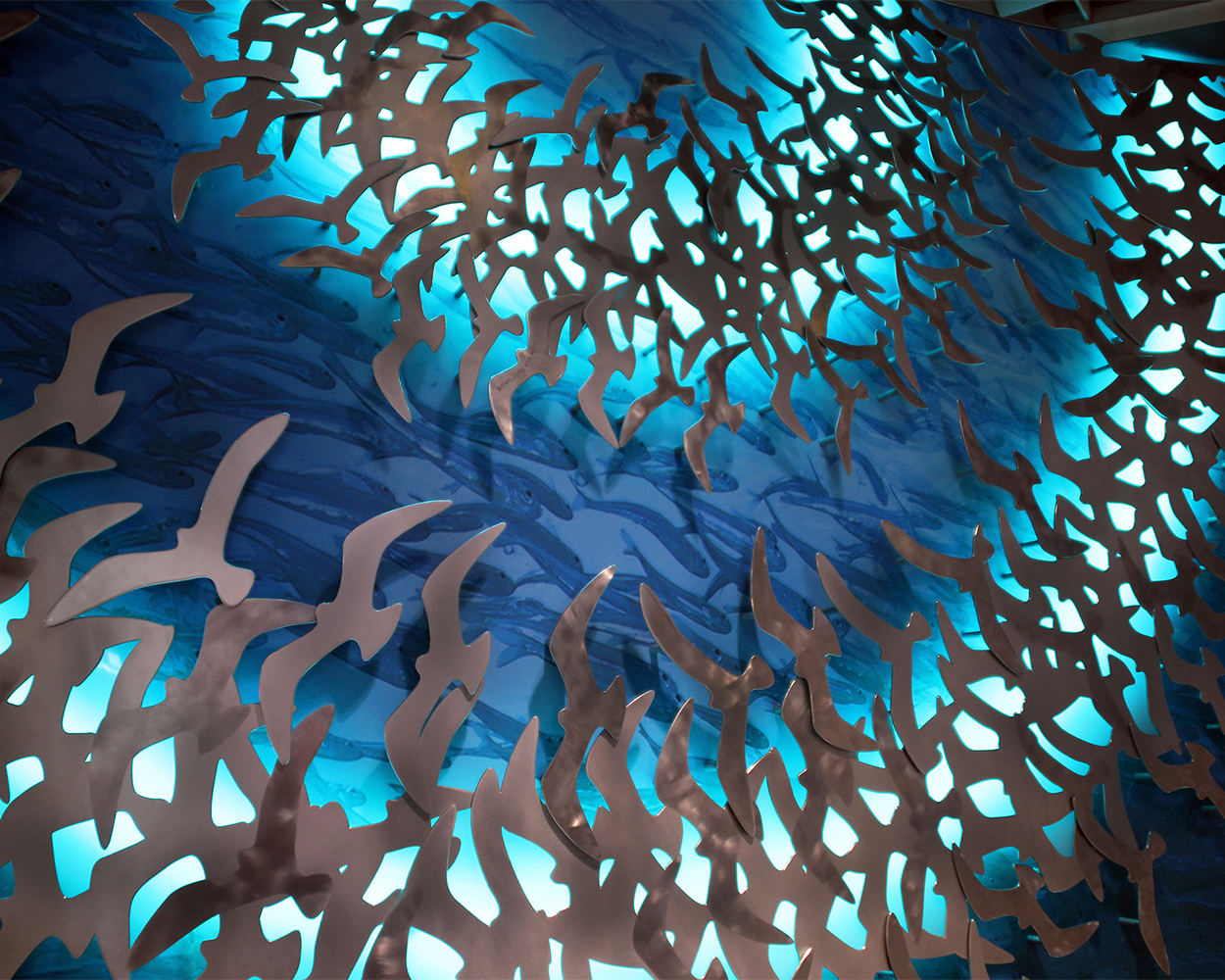

Sea of Support

Showcase your dedication to the conservation of the natural environment and the future of The Florida Aquarium with a meaningful and memorable gift displayed on our beautifully crafted Sea of Support gallery.

Other Ways to Donate

Planning for the future is critically important – from protecting your own financial security to that of the natural environment. From estate giving to Qualified Charitable Distributions to gifts of securities, stocks, crypto and mutual funds, we invite you to explore the many ways you can support our shared purpose to save marine wildlife.